What did I miss?

The ATO wields Part IVA against professional practices distribute profits in two new cases before the AAT.

Professional practices have been in the ATO spotlight for many years now for the way they distribute profits. However, with two new cases before the AAT, the ATO is gaining momentum. We look at the uptick in activity in this area.

Plus, a Full Federal Court decision this month revisits some of the key principles on travel deductions.

As change occurs, we’ll keep you posted through our social media accounts. – Twitter, Facebook, and LinkedIn.

From Government

Introducing a global 15% minimum tax rate

Following the announcement in the Government’s 2023-24 Federal Budget, Treasury has now released draft legislation and explanatory materials for consultation on a proposed measure to impose a 15% global minimum tax and domestic minimum tax rate.

The global minimum tax and domestic minimum tax rates will apply to large multinationals with annual global revenue of EUR750 million (approximately $1.2 billion) or more.

In conjunction with this, Treasury has also released a discussion paper seeking feedback on interactions between these proposed measures and existing income tax provisions, including the hybrid mismatch rules, controlled foreign company rules and the foreign income tax offset system.

More information

International taxation – global and domestic minimum tax – primary legislation

International taxation – global and domestic minimum tax – subordinate legislation

Tax on super earnings over $3m for defined benefit super and pension plans

Treasury has released draft regulations for consultation that enable the calculation of the total superannuation balance for certain defined benefit super and pension plans, with a proposed start date of 1 July 2025.

In broad terms, the regulations are intended to enable treatment that is commensurate with account-based schemes under the proposed Division 296 measure when determining tax on earnings of superannuation balances over $3,000,000.

The regulations deal with both defined benefit pensions and defined benefit schemes that are in the pre-retirement phase. The Division 296 income calculation includes adjustments for contributions and withdrawals. The draft regulations also provide a method to calculate contributions and withdrawals under the proposed Division 296 measure.

More information

Better targeted superannuation concessions: draft regulations

Expanding Australia’s tax treaty network

The Government is looking to expand and update Australia’s tax treaty network.

To that end, the Government has entered into negotiations with Brazil and Ukraine on establishing a new tax treaty. The Government has also entered negotiations with New Zealand, South Korea and Sweden to update existing treaties.

Treasury is seeking submissions on the preferred outcomes in negotiating these tax treaties and any other issues related to Australia’s tax treaty network.

More information

Expansion of Australia’s tax treaty network

Australia to negotiate new tax treaties with Ukraine and Brazil

Removing certain tariffs

The Government is proposing to remove around 500 tariffs in order to simplify Australia’s trade system and ease cost of living pressures.

These tariffs have been identified as imposing unnecessary administrative and compliance costs on Australian businesses with such tariffs often applying to goods that arrive under a concessional rate. The list of tariffs identified for removal includes those applying to imported household goods such as toothbrushes, tools, fridges, dishwashers and clothing.

Ahead of finalising this list, Treasury is seeking views from interested parties on the list of tariffs selected for removal.

More information

Tariff reform: removal of nuisance tariffs

From the Regulators

Updated small business benchmarks

The ATO has updated its small business benchmarks for the 2021-22 income year. The benchmarks are calculated from over 1.9 million small business tax returns and apply across a broad range of industries.

The ATO uses benchmark information as one of the tools to identify businesses that might not be declaring all of their income or that might be avoiding some of their tax obligations.

Practitioners can also use these benchmarks to identify clients who might be at higher risk of ATO audit or review activity. The benchmark information can basically operate as an early warning that clients might be subject to a higher level of ATO scrutiny.

Just keep in mind that if a business falls outside the benchmarks, this doesn’t necessarily mean that there is a problem. There may well be commercial reasons for the differences. The key is to try and identify those differences with the aim of showing that the client is fully compliant with the tax laws despite falling outside the benchmarks.

More information

Use our small business benchmarks to improve your business

Withholding variations for foreign residents selling Australian property

The foreign resident capital gains withholding tax regime has been in place since 1 July 2016.

In broad terms, the regime imposes a withholding rate of 12.5% on the sale of Australian properties of $750,000 or more if the vendor is a foreign resident or hasn’t obtained a clearance certificate from the ATO.

However, foreign resident vendors might be eligible to apply for a variation from the ATO if the 12.5% withholding is too high after taking into account the actual Australian tax liability on the sale. The most common reasons for a variation include making a capital loss, not having an income tax liability and foreclosure.

The ATO has identified that over 60% of variation applications were lodged late in 2023 which means that the purchaser has no choice but to withhold at 12.5%. The ATO is reminding taxpayers that variations must be lodged online at least 28 days before settlement date to ensure sufficient processing time and that the sale contract should also be lodged with the application.

For practitioners dealing with Australian residents, they should obtain a clearance certificate before settlement (instead of a variation) to avoid the foreign resident withholding rules from applying.

More information

Foreign residents selling property in Australia

Rulings, Determinations & Guidance

Bowerman main residence Decision impact statement

The ATO has issued a Decision Impact Statement in response to the AAT decision in Bowerman and Commissioner of Taxation [2023] AATA 3547.

The taxpayer in that case was successful in arguing that she should be entitled to claim a tax deduction for the loss that arose from selling a private residence. This was largely because the taxpayer’s purpose of living in the property was considered secondary to a more significant profit-making purpose.

Instead of appealing the decision, the ATO has issued a decision impact statement.

While the ATO accepts the factual findings were open to the AAT, it also considers that the unusual facts of the case will limit the application of the AAT decision to future cases. Rather, the ATO considers the decision must be read in the context that a profit-making purpose alone is not sufficient to mean that the sale is on revenue account.

The ATO’s comments will be somewhat of a relief for many practitioners because the decision arguably sets a low bar for when the sale of a property could be taxed on revenue account. If the property is taxed on revenue account, this has flow-on implications for taxpayers trying to access the 50% general discount as well as other CGT concessions such as the main residence exemption.

More information

Bowerman and Commissioner of Taxation

GST on combination foods

The ATO has now finalised determination GSTD 2024/1 which considers when food is considered a “combination food”.

In very broad terms, food is denied GST-free treatment where it is considered a combination of one or more foods where at least one of the foods is a taxable food. This is referred to as “combination food”.

More recently, this issue was considered by the AAT in Chobani Pty Ltd and Commissioner of Taxation [2023] AATA 1664. The AAT looked at this issue in the context of a flip yoghurt containing both GST-free yoghurt and taxable dry ingredients (i.e., chocolate and biscuit pieces) in separate compartments.

The AAT concluded the flip yoghurt was a combination food and therefore not GST-free, having regard to the fact that the taxable dry ingredients were not insignificant, they remained identifiable and they were not subsumed into a separate product.

Following the Chobani decision, the ATO has now finalised GSTD 2024/1 which deals with this area. While the final ruling now provides further clarity on some aspects, it is largely consistent with the draft version.

The ATO still retains the view that the following three principles need to be considered to determine when a combination food is being supplied:

- There must be at least one separately identifiable taxable food.

- The separately identifiable taxable food must be sufficiently joined together with the overall product.

- The separately identifiable taxable food must not be so integrated into the overall product, or be so insignificant within that product, that it has no effect on the essential character of that product.

More information

GSTD 2024/1

GST on prepared meals

Following the Federal Court decisions in Simplot Australia Pty Limited v Commissioner of Taxation [2023] FCA 1115, the ATO has issued a draft determination which looks at when products are considered food of a kind that is marketed as a prepared meal.

Food is denied GST-free treatment where the food is of a kind that is marketed as a prepared meal (although this specifically excludes soups).

In the draft determination the ATO sets out some key principles on how to approach this issue and provides a number of examples.

The ATO considers the question is whether the product is a member of a class of products that are marketed as a prepared meal. This means it is necessary to consider the kinds of food that are marketed as a prepared meal.

Marketing in this context means the activities of the seller in terms of selling and promoting the product, which will include labelling, packaging, display and advertising.

The attributes of a prepared meal are determined by common experience and include considerations regarding the following:

- Quantity – a meal normally connotes a ‘quantity of substance’;

- Composition – a food’s composition is consistent with being a prepared meal where it is made from multiple ingredients or elements; and

- Presentation – a food’s presentation will indicate it is a prepared meal if it is presented as ‘complete’ requiring further limited assembly and cooking, as well as a complete meal which might be indicated by the inclusion of seasoning, sauces and flavouring.

More information

GSTD 2024/D1

FBT cents per km rates on the private use of motor vehicles other than cars

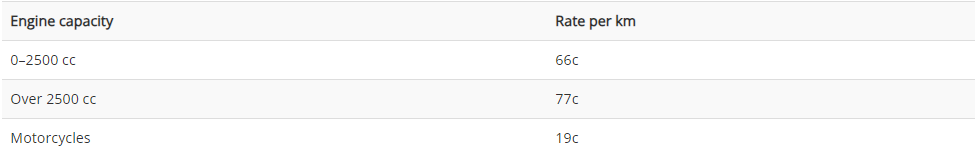

The ATO has issued TD 2024/1 which sets out the updated cents per kilometre rates for calculating the taxable value of fringe benefits arising from the private use of motor vehicles (other than cars) applying from 1 April 2024.

More information

TD 2024/1

Alternative records for FBT record keeping

Legislation was passed in June 2023 aimed at reducing FBT compliance costs by simplifying certain record keeping requirements.

Instead of being required to obtain specific documents such as employee declarations, there is now an option for employers to rely on alternative records to comply with FBT record keeping requirements.

The ATO was given powers to issue legislative instruments to determine the kind of alternative records that can be kept and retained by employers. The ATO has now finalised some legislative instruments to cover alternative records for the following areas:

- Temporary accommodation relating to relocation (LI 2024/8);

- Relocation transport (LI 2024/12);

- Remote area holiday transport (LI 2024/10);

- Car travel to certain work-related activities (LI 2024/9);

- Car travel to employment interview and selection tests (LI 2024/14);

- Living away from home (LI 2024/4 and LI 2024/5);

- Otherwise deductible benefits (LI 2024/6);

- Travel diaries (LI 2024/11);

- Overseas employment holiday transport (LI 2024/13); and

- Private use of vehicles other than cars (LI 2024/7).

Each of these legislative instruments has a commencement date for the FBT year starting from 1 April 2024 onwards.

Reporting of sharing economy transactions

Electronic platforms operating in the sharing economy have obligations to report transactions made through their platform to the ATO under the sharing economy reporting regime.

These reporting obligations already apply to transactions from 1 July 2023 onwards for most ride-sourcing and short-term accommodation platforms. For other impacted sharing economy platforms (such as in areas of asset sharing, food delivery, etc.), they will be required to report transactions from 1 July 2024 onwards.

The ATO has now issued a draft legislative instrument that provides some limited exceptions from the reporting regime. These exceptions are targeted at situations where the ATO considers there’s a low risk to tax collection or where the information would otherwise be reported by other electronic distribution platforms.

With these exceptions being quite limited, the key message is that it would be prudent for practitioners to remind clients engaged in the sharing economy that the ATO is collecting data from electronic platforms. This is being done with the view of data matching this information with disclosures in tax returns and activity statements.

More information

LI 2024/D1

Cases

Part IVA and trust distributions to loss entities and tax-exempt entities

The AAT has released decisions on two cases dealing with similar arrangements. The cases broadly involve a solicitor who controlled a number of practice trusts that derived profits through marketing and facilitating tax planning arrangements.

While the arrangement in each case was complex and involved a large number of steps, the practice trusts ensured their business profits weren’t subject to tax by essentially making trust distributions on paper through a series of trusts and ultimately to either a company that had existing tax losses or a tax-exempt entity. However, the real funds relating to the trust distribution (less a commission paid for the use of these entities) were ultimately received by the solicitor or their associated entities in the form of a loan.

The ATO argued that the general anti-avoidance provisions in Part IVA applied to the arrangements such that the solicitor in each case should be personally assessed on these amounts. In very broad terms, the anti-avoidance provisions in Part IVA apply to schemes undertaken with the sole or dominant purpose of obtaining a tax benefit.

The key argument of the taxpayer was that they did not derive a tax benefit from the scheme. The solicitors argued that they were personally exposed to a high degree of risk and for asset protection reasons they would have ensured that they would not receive trust distributions personally had the scheme had not been entered into.

The AAT disagreed with the taxpayer’s argument having regard to following:

- It was not sufficient to show that the taxpayer would not have derived the trust distribution had the scheme not been entered into, they were also required to positively show who the trust distributions would have been made to; and

- In any case, it was not unreasonable to expect some or all of that profit to be assessed to the taxpayer where the profits of a business rely on the taxpayer’s own efforts.

Considering the artificial and contrived manner of making trust distributions on paper through a series of trusts ultimately to tax-exempt and loss companies, the AAT also concluded that obtaining a tax benefit was the dominant purpose of the scheme.

Practitioners should approach situations like this carefully. It is important to be aware that there are a number of ways in which the ATO can potentially challenge arrangements involving the distribution of profits from a professional practice. For example:

- If a trading entity derives personal services income that mainly relates to the skills and efforts of a particular individual, the ATO has certain expectations around ensuring the profits are assessed to the individual performing the work. This is regardless of whether the personal services income tests are passed or not.

- If a trading entity doesn’t derive personal services income but income from a business structure involving a professional practice, the ATO has released PCG 2021/4 which sets out its compliance approach to targeting arrangements that don’t result in a reasonable level of profit being taxed in the hands of the individual practitioners.

- If a trust makes paper distributions to loss entities to soak up deductions or losses, the integrity rules in section 100A also need to be considered. The ATO has recently issued TR 2022/4 and PCG 2022/2 which deal with this area.

More information

Collie and Commissioner of Taxation (Taxation) [2024] AATA 440

Grant and Commissioner of Taxation (Taxation) [2024] AATA 427

Part IVA and failing to distribute amounts to unit holders

In another case that considers the anti-avoidance provisions in Part IVA, the Full Federal Court decision in Minerva Financial Group Pty Ltd v Commissioner of Taxation [2022] FCA 1092 involves a unit trust that was indirectly and ultimately owned by a foreign group.

The Full Federal Court considered whether the anti-avoidance provisions applied where the trustee of a unit trust did not exercise their discretion to make trust distributions comprising interest income to a holder of some special units.

Prior to a restructure and in anticipation of an initial public offering, an Australian company was the original direct holder of all the units in various unit trusts that derived interest income. This meant that the interest income was originally taxed at the corporate rate of 30% in the hands of the Australian company.

While the restructure involved a couple of steps, it basically resulted in:

- The Australian company holding only special units in the unit trust with those units not carrying any rights to income distributions unless the trustee exercised a discretion; and

- Another Australian resident trust holding ordinary units in the same unit trust. The units of this other Australian resident unit trust were solely held by foreign entities.

Whether the interest income was distributed to the ordinary or special unit holders would have triggered different tax implications.

If the distributions were made to the special unit holder (being an Australian resident company), the profits would have been exposed to a higher 30% corporate rate of tax in Australia.

On the other hand, if the distributions were made to its ordinary unit holders (being an Australian resident trust), the distribution would ultimately flow through to a foreign entity. The distribution would basically have been subject to a lower non-resident interest withholding rate of 10%.

The ATO sought to argue that the anti-avoidance provisions in Part IVA applied to this arrangement.

While the ATO was successful at the Federal Court, the Full Federal Court ruled in favour of the taxpayer, concluding that the parties did not enter into the scheme for the dominant purpose of securing a tax benefit. The Full Federal Court reached this conclusion, having regard to the following reasons:

- In the absence of the trustee exercising its discretion, the special unit holders did not have an entitlement to the trust distribution comprising the interest income. Rather, the trust made distributions to its ordinary unit holder in accordance with the trust constitution and the terms on which the units had been issued (i.e., this was an expected feature of those units);

- The distribution to its ordinary unit holder conferred real economic advantages, allowing the ultimate foreign company to repay debts owed to the Australian company unit holder; and

- While the ATO sought to make a comparison of the unit trust’s flow of distributions prior to the restructure, the ATO failed to consider (amongst other things) that there was a change in commercial circumstances (e.g., a business need for further financing).

More information

Minerva Financial Group Pty Ltd v Commissioner of Taxation [2022] FCA 1092

Travel deductions for FIFO workers

The Full Federal Court in Bechtel Australia Pty Ltd v Commissioner of Taxation [2024] FCAFC 33 looked at the FBT treatment of travel that was provided to the taxpayer’s fly-in-fly-out employees and whether the otherwise deductible rule could apply to reduce the taxable value of the benefit.

In summary, the employer both organised and paid for an employee’s travel between their home airport and the project site where they commenced their roster and shift.

The taxpayer argued that FBT did not apply due to the otherwise deductible rule, based on principles established in the Full Federal Court decision in John Holland Group Pty Ltd v Commissioner of Taxation [2015] FCAFC 82. The John Holland case dealt with similar circumstances where certain fly-in-fly out workers were responsible for making their own way to an agreed departure point (e.g., Perth airport) from which the employer transported them to their place of work.

The Full Federal Court in John Holland concluded that the otherwise deductible rule applied to the relevant travel undertaken by the employees, because they were travelling in the course of their employment. Importantly, this decision was reached having regard to the fact that from the agreed departure point (e.g., Perth airport) the employees had already reported for duty and were rostered on, were paid for the time they were travelling and were also subject to the employer’s direction and control.

The main issue in the Bechtel case was that the employees did not commence their roster and shift until they arrived at the project site. This was critical to the Full Federal Court’s conclusion that the employee’s travel was undertaken before the employee commenced their employment duties. This was despite:

- The employer having policies that governed employee conduct when away from the project location (e.g., including while travelling);

- The employees receiving a project allowance due to the remoteness of the project location; and

- The employer facilitating and arranging for the travel.

As a result, the travel expenses would not have been deductible to the employee personally and were therefore not ‘otherwise deductible’ for FBT purposes.

For practitioners with clients that arrange travel for fly-in-fly-out workers to ‘remote’ locations, it’s important to remember that there is a specific FBT exemption that can sometimes apply. If this exemption isn’t available (e.g., the location is not in certain ‘remote’ areas) and clients are seeking to rely on the otherwise deductible rule instead, this case demonstrates a need to review the arrangement and employment policies in detail.

More information

Bechtel Australia Pty Ltd v Commissioner of Taxation [2024] FCAFC 33

Legislation

The last sitting of Parliament pre the Federal Budget has now concluded. Several Bills and legislation remain pending. This includes:

Treasury Laws Amendment (Support for Small Business and Charities and Other Measures) Bill 2023 that includes the amendments to:

- Instant asset write off – increases the instant asset write-off threshold from $1,000 to $20,000 for 2023-24 (the Senate has recommended an amendment that increases this threshold to $30k)

- Tax deduction for electrification – The 2023-24 bonus tax deduction relating to electrification and efficient energy use, and

- Non arm’s length expenses for SMSFs – The new rules for non-arm’s length expenses for SMSFs.

Superannuation (Better Targeted Superannuation Concessions) Imposition Bill 2023 that introduces the 15% Division 296 tax on super balances that exceed $3m. The Senate Economics Legislation Committee is not due to report back on this one until 10 May 2024.

Treasury Laws Amendment (Delivering Better Financial Outcomes and Other Measures Bill 2024)

This Bill has been introduced into Parliament and targets several areas.

First, the Bill makes proposed amendments to implement the Government’s response to 11 recommendations from the Quality of Advice review. This includes proposed amendments to the SIS Act by clarifying the legal basis in which superannuation trustees are able to pay advice fees from a member’s superannuation account at the request of the member and provides certainty that the payment of certain personal advice fees by a superannuation trustee are deductible to the fund.

The Bill also introduces the following proposed amendments:

- To clarify the meaning of the phrase ‘exploration for petroleum’ in the context of Petroleum Resource Rent Tax Act;

- To ensure that mining, quarrying or prospecting rights cannot be depreciated for income tax purposes until they are used; and

- To clarify the circumstances in which the issue of new mining, quarrying or prospecting rights over areas covered by existing rights lead to income tax adjustments.

With regards to the location and production tax offset relating to film expenditure, the Bill introduces the following proposed amendments:

Location tax offset

- An increase in the rate of the location tax offset from 16.5% to 30% of the company’s total qualifying Australian production expenditure on films;

- An increase of the company’s minimum qualifying Australian production expenditure on a film from at least $15 million to $20 million;

- An increase to the minimum amount of total qualifying Australian production expenditure on a film per hour from $1 million to $1.5 million;

- An additional requirement to satisfy a minimum training expenditure requirement test or satisfy alternative requirements in relation to establishing and upgrading film infrastructure or providing training programs;

- Additional conditions to require some post, digital and visual effects for productions to be provided by Australian providers or through an Australian permanent establishment; and

- Enable the Arts Minister to request specific information in relation to the location tax offset.

Producer tax offset

- Adding a new threshold category to the producer tax offset for productions spending a minimum of $35 million of qualifying Australian production expenditure for a season of a drama series.

More information

Treasury Laws Amendment (Delivering Better Financial Outcomes and Other Measures) Bill 2024